Sign up to get instant access to the Money-Ful Toolkit!

Want more profitable + strategic content? Grab my free content planner!

I’m Hailey – content strategist and founder here at Your Content Empire where we help you create more profitable, purposeful and productive content — and hopefully enjoy yourself more while doing it too. Learn more about me here >>

As an admittedly heart-centred entrepreneur, money is one of those things that I've had to gradually become more comfortable within my own business – managing it, planning for it, spending it and receiving it. So in this post, I'll be walking you through my complete guide to money for entrepreneurs. It’s all broken down for you into the foundation aspects of managing money including money mindset, money systems and money plans.

Then we’ll move into money systems so you can learn more practical tools for managing your money better. Then we’ll talk about money plans, which is laying down the routines for you to actually apply your management techniques.

Lastly, I’ll also be sharing my personal money routines so you can get a little insight into my routine for managing my money daily, weekly, monthly, and quarterly.

If you want all of this great information in a handy PDF, download the Money-Ful Toolkit.

Go into any entrepreneurial Facebook group and throw a stone with your eyes closed. I'm willing to bet you'd land on someone talking about money mindset or manifesting.

You may be thinking “how cliché”, but there's a reason why money and mindset have that reputation: It's one of the most significant determining factors in how high your ceiling for success is.

It's super hard being an entrepreneur and sometimes feeling like your worth is all tied up in how much you charge for your work and how many people want it. For me, cultivating a healthy mindset around money is about clearing any mental or emotional blocks I have, training myself to see opportunities that may be easy to miss, and taking care of my money by giving it the respect it deserves.

When it comes to money mindset, there are some tools that have rightfully become my go-tos, which I’m sharing below.

Money Bootcamp was my first foray into developing a better money mindset, and I felt like I’d walked through the wardrobe into Narnia when I first logged in. Money Bootcamp is designed to help you reprogram your money mindset, and it works. After joining, a whole new way of thinking about money opened up to me.

I try to go back through the program every year and notice whenever I’m diligent with tracking my income, upleveling other areas of my life, and working through my emotional issues around money that the big U responds and sends the most unexpected blessings my way. If this message resonates with you, you can find out more about Money Bootcamp here.

Jacquette has such a unique perspective when it comes to money, so reading her newsletter and content always challenges me to think about my money a little differently. She writes my favourite money newsletter because it’s full of thoughtful questions to think about when it comes to your money. Jacquette also provides lots of actionable takeaways.

A nugget from a recent email that I loved: Every relationship has a job and the same applies to your relationship with money. When you acknowledge the “job” of your relationships, it helps you to be a better participant in those relationships. So what duty, role or function are you giving your money?

If you want to drive right into a few of my all-time favourite blog posts by Jacquette, check out any of the ones below:

Money systems refers to the routines and processes you use to manage your money

Without them, you’re essentially turning a blind eye to your money, meaning that you’re unaware of what you’re spending and how you’re making money. This puts you and your business at a disadvantage.

Having systems in place allows you to be strategic with your money, whether that means making more or simply doing more with the money you’re making.

As a business owner, you have specific financial responsibilities. By not having a system for your bookkeeping, you are putting yourself in the ultimately stressful situation of cramming to get your bookkeeping ready at tax time. No, thanks!

Here are some resources I love when it comes to creating my money systems.

I.LOVED.THIS.BOOK. The Heart of Your Money is also a great resource for your money mindset, but I’ve included in the money systems section because she also ties in practical systems for managing your money.

Zena teaches a value-based weekly cash system, and it’s been exactly what I needed to stick to a budget without feeling like I was depriving myself. Plus it’s peppered with stories and examples that make it as enjoyable to read as it is valuable.

And if you buy the book, you also get a free workshop to uncover your money origin story and discover how to change it so it doesn’t hold you back anymore. Learn more about The Heart of Your Money here.

The system that completely changed my approach to money management for my business was in the book by Mike Michalowicz, Profit First.

Following his system, I divide every payment I receive from clients and weekly transfers from Stripe/PayPal and divide into 5 categories:

These aren’t necessarily the traditional percentages, but that’s what I love about Profit First. It’s the system that works, so the percentages are flexible. It’s worth noting that I’m in Canada and our taxes are different, so I’ve updated the percentages based on what makes sense for me.

At the end of each quarter, I take half of what I've transferred into my profit account (the rest is there as a sort of emergency fund) and use it as a bonus. Usually a bit goes to something personal and the rest is invested into a fun project for my business.

Before using Profit First, paying myself was kind of a joke. And now it’s becoming a non-negotiable (definitely still a work in progress, but I’m sticking to it!).

Click here to check out the book on Amazon!

A big thank you to Amber for providing the easiest application for Profit First for business owners. Her profitability calculator tool tells you what percentages need to go where. It’s really easy to use, so I highly recommend adding it as a part of your money system.

The final component of the busy business owner’s relationship to money is a plan. You’ve got the mindset and systems, now let’s put those to good use by creating a plan for your money. I like to think of this as being proactive with how I’m bringing in money and spending my resources.

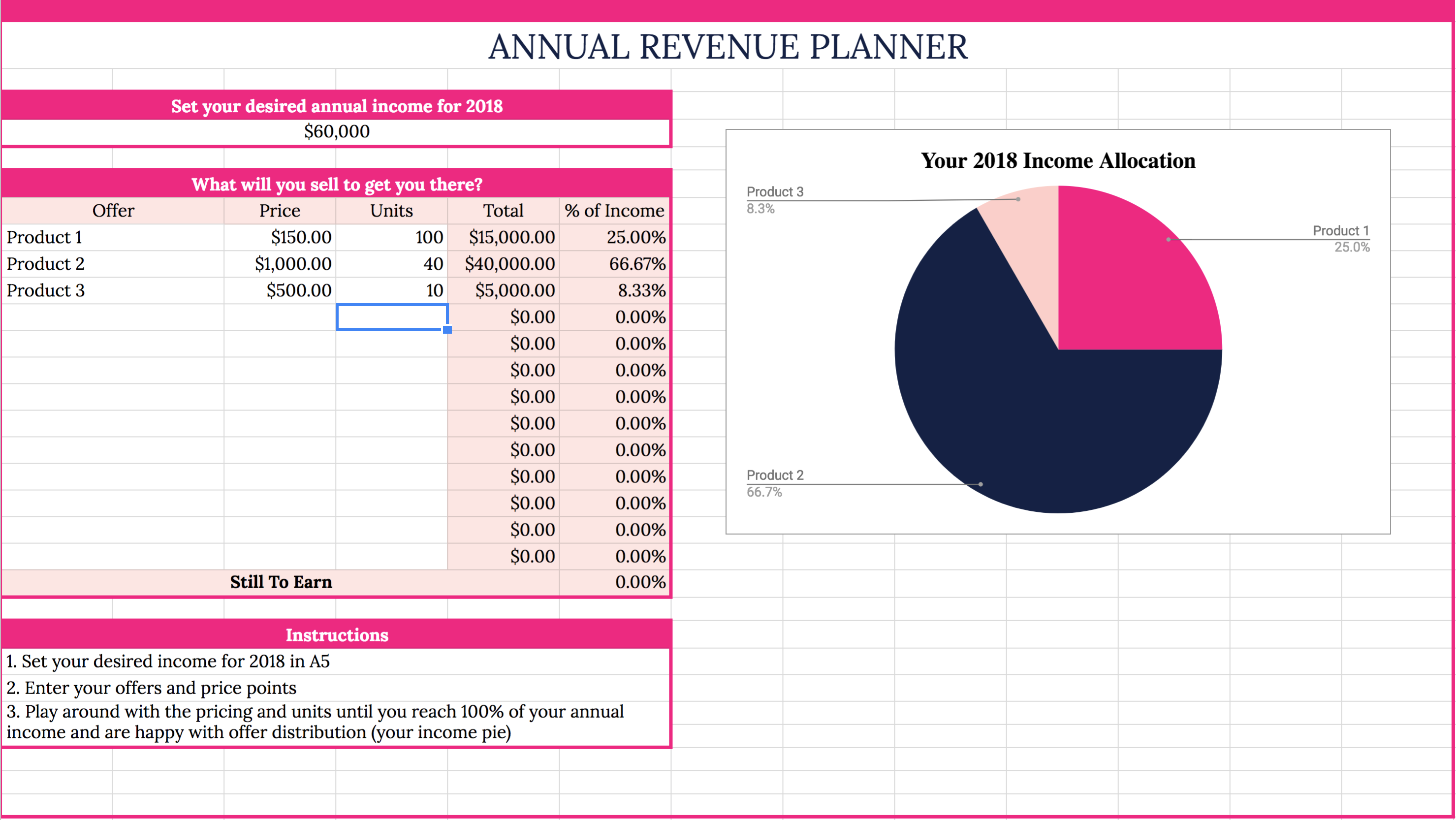

The next thing that has really improved my relationship with revenue is having a revenue plan (ha!) Before it, goal setting would be a little something like this. “I want to make $100K this year.” No how, no when, no why.

Then at the end of year, when it didn't magically happen, I'd conclude that money hates me and I'm a huge failure when it comes to running a business.

Clearly I needed to try something different.

What does that money goal look like in terms of how many sales you need to make? Then what if those goals were spread out over the year? Maybe not so unrealistic anymore, right? I have a free revenue planner here that you can download and access through the Money-Ful Toolkit.

The next thing I did to level-up my money mindset was to cultivate an awareness about where my time was going, which involved tracking my time.

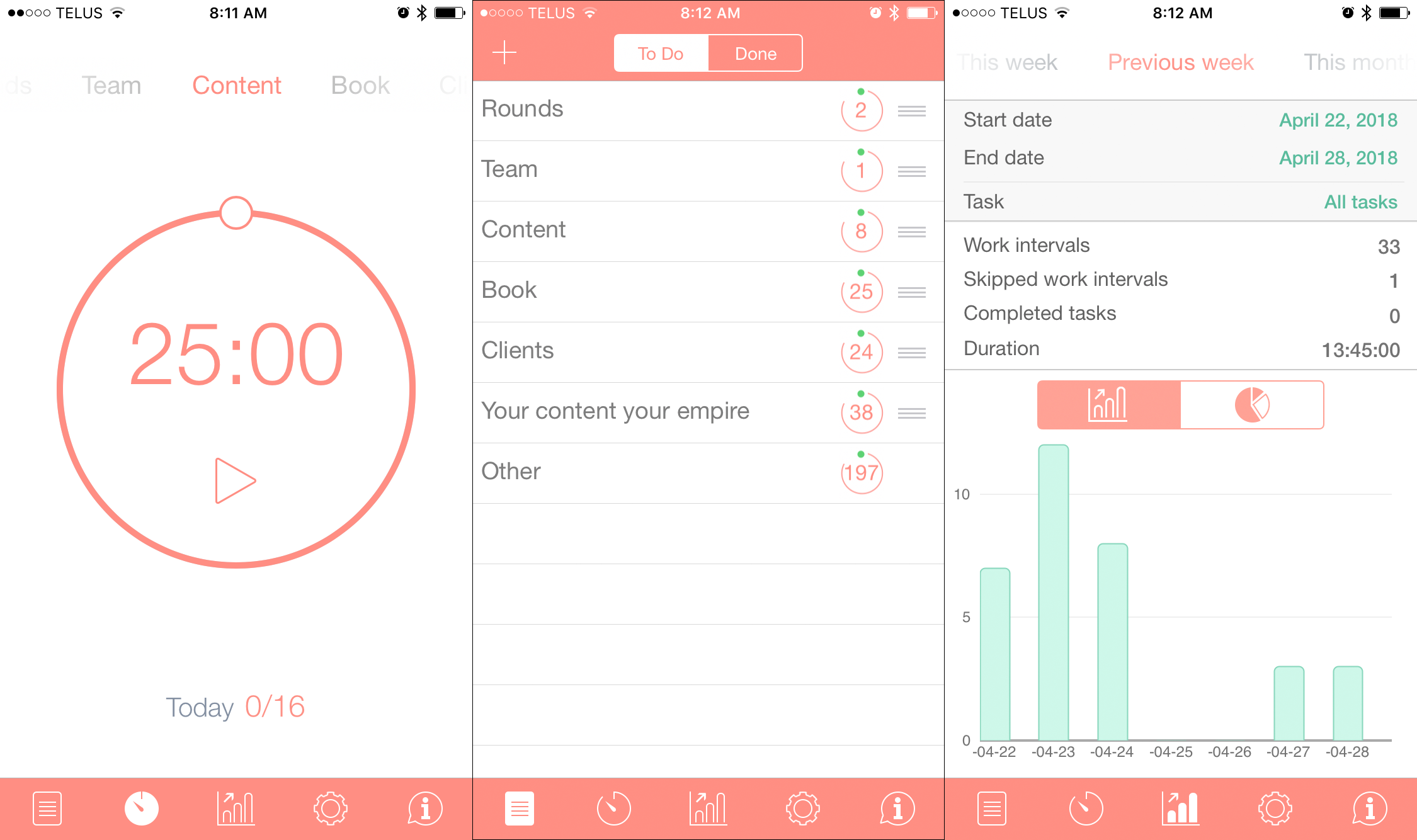

You can use something like Toggl for this, but I took the opportunity to combine my affinity for the Pomodoro method and this time tracking through using BeFocusedPro.

It's an app that lets me add categories and then work in 25 minute sprints. I can set a goal for how many ‘sprints' I want to complete each day, and then get a report on how many I did each day and where each one was spent.

I also use this in my weekly-monthly-quarterly planning process so that if I don't meet a certain goal, I can usually discover what’s behind that issue. For example, when working towards a revenue goal that I didn’t reach, I may uncover that I spent too much of my time on non-revenue generating activities.

Learn more about the BeFocusedPro app here.

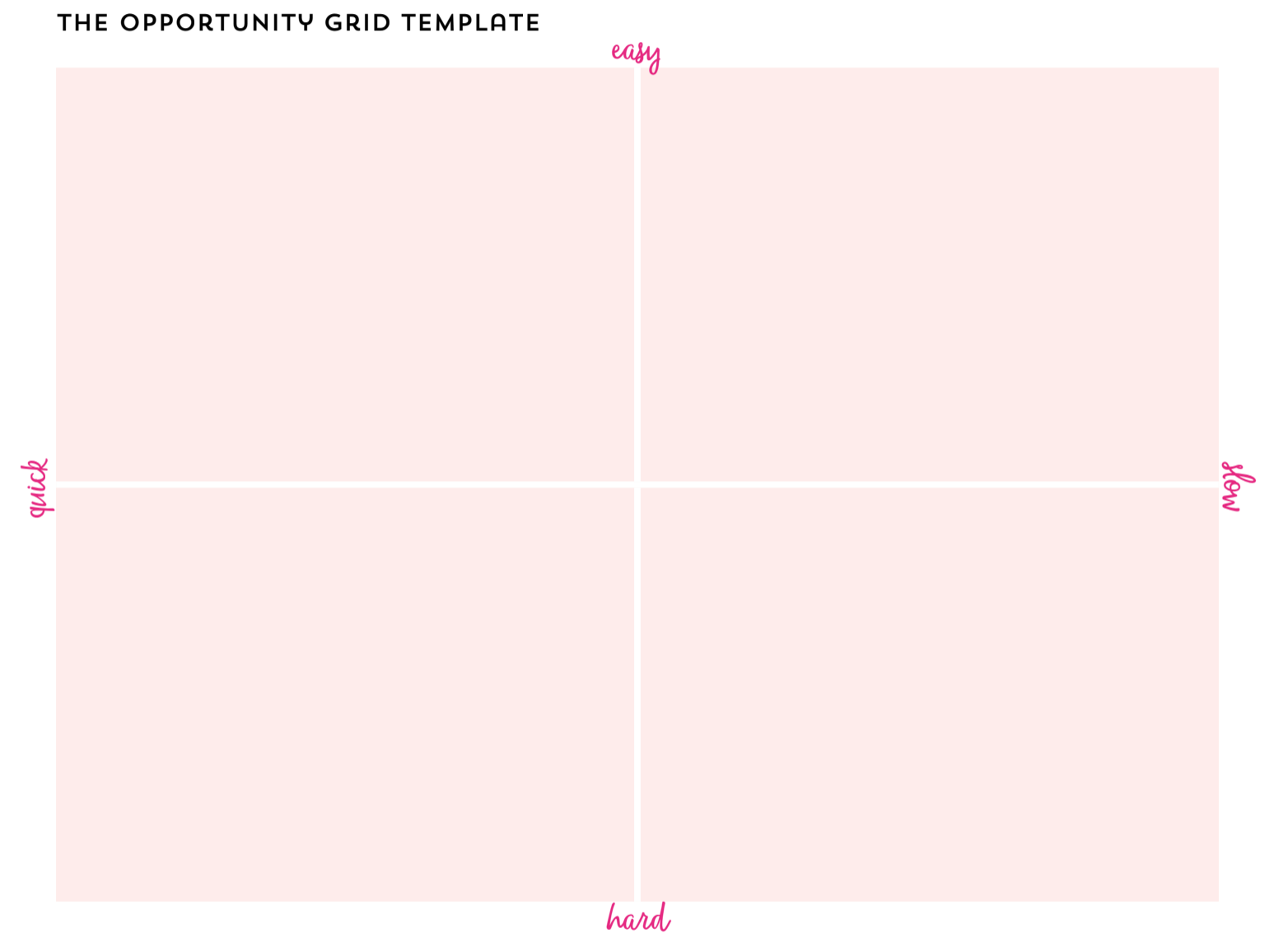

Ready to blow your own mind with all the opportunities that are sitting right in front of you? Denise Duffield-Thomas taught this in Amber McCue’s Planathon, and I’ve been using an adapted version of it for years now.

Step 1 – Download the grid template as part of the Money-Ful Toolkit or just draw this on a piece of paper

Step 2 – In the first quadrant, write down any opportunities for money or business that are quick and easy. Maybe it’s following up with people, or sending out an invoice.

Step 3 – In the second quadrant, write down any opportunities for money or business that are slow and easy. Maybe it’s finishing the last few steps of a client project and sending in the invoice.

Step 4 – In the third quadrant, write down any opportunities for money or business that are slow and hard. These might be the things that have the biggest potential ROI like finishing up a new offer, preparing a launch of your products or services.

Step 5 – You got the drill now! In the fourth quadrant, write down any opportunities for money or business that are quick and hard. Maybe it’s cold emailing someone a proposal or sending out a promotion email to your list.

Denise Duffield-Thomas wrote that “money tracking daily keeps you mindful of what’s actually going on in your life, helps you appreciate the abundance around you, and sometimes gets your butt into gear to make more money.”

I think she summed it up perfectly – especially the last part, which is a reminder that systems only work if you work them. For that reason I have my own personal money routine built out with systems and a plan. There are different parts of this routine that I follow daily, weekly, monthly and quarterly.

Daily:

Weekly:

Monthly:

Quarterly:

As a business owner, it’s really crucial that you don’t turn away from what’s happening financially in your business. Once you tackle the first hurdle of a healthy money mindset, the next steps of money systems and money planning fall into place a little easier.

Money matters don’t have to be stressful or overwhelming. As a busy business owner, you should have a routine in place that keeps your money management process seamless. With the right tools, such as those included in this blog post, you can set yourself up for financial success.

Do you want to learn about even more tools and resources? Download the full Money-Ful Toolkit PDF below

Most of the problems with your current content strategy can be fixed with one tiny shift—changing how you plan your content. Specifically your monthly content planning process which we're covering in this post ↓ The issue with the typical approach is that people make...

Do you have a monthly membership that you’re struggling to get new members in? Or maybe you have a steady stream of new members, but you want to scale it so you have a higher monthly recurring revenue? In this video, I’m giving you the ultimate monthly marketing plan...

Today I want to share with you how I doubled sales in my funnel with the exact same number of leads. Because, while yes, you can definitely increase the amount of traffic you’re driving to the top of your funnel—it’s always best to do so once you know your funnel is...